AppLovin shares plummeted on Monday after Bloomberg reported that the U.S. Securities and Exchange Commission (SEC) has been investigating the company’s data-collection and ad-targeting practices.

SEC Acting on Whistleblower Complaint

According to Bloomberg, the SEC probe focuses on whether AppLovin violated agreements or internal policies related to pushing targeted ads to consumers. The investigation reportedly stems from a whistleblower complaint filed earlier this year and multiple short-seller reports questioning the company’s handling of user data.

The agency is examining whether AppLovin’s technology – which powers ad targeting for thousands of apps – properly safeguards consumer information and complies with disclosure obligations to investors.

Shares Slide After Report

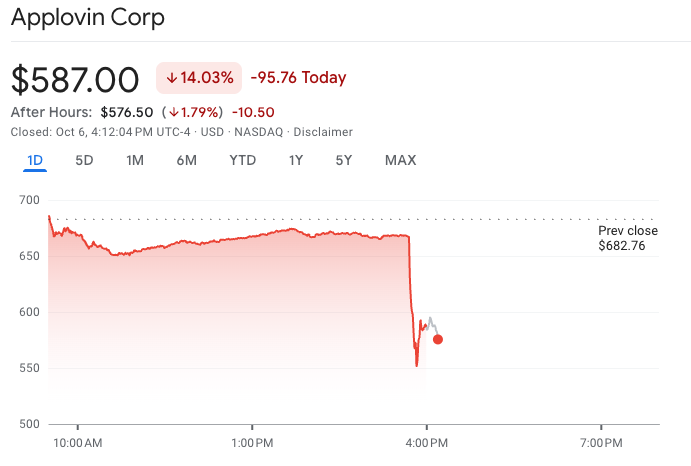

AppLovin stock fell 14% on Monday to close at $587, erasing nearly $5 billion in market value. The sell-off followed an extended rally that saw the shares surge roughly 80% this year, after soaring more than 700% in 2024.

The company’s meteoric rise had been driven by the success of its AI-powered advertising engine, which helps brands reach consumers more effectively across mobile devices. The SEC probe now threatens to cloud that growth story and raises new questions about compliance risks in the ad-tech industry.

Short-Seller Pressure

AppLovin has faced mounting scrutiny from activist investors. In March, short-selling firm Fuzzy Panda Research urged the S&P Dow Jones Indices committee to exclude AppLovin from the S&P 500, citing governance and transparency concerns.

Despite that warning, the company was added to the benchmark index last month, replacing MarketAxess Holdings. Trading app Robinhood joined the S&P 500 at the same time, taking the spot previously held by Caesars Entertainment.

AppLovin’s inclusion marked a milestone for the company but also intensified attention from institutional investors and regulators alike.

Company Response

AppLovin said it is cooperating with regulators and remains confident in its compliance practices.

“We take privacy and transparency seriously and believe our disclosures are accurate and complete,” the company said in a statement.

The firm added that it continues to operate within major privacy frameworks such as the GDPR and CCPA, emphasizing that its business practices meet global standards.

What’s Next

The SEC has not publicly commented on the probe, and no formal charges have been announced. Legal experts note that such investigations can take months and may expand if new evidence emerges.

AppLovin will have an opportunity to address investor concerns during its next earnings call on November 5, 2025, when it reports third-quarter results after the U.S. market closes. Analysts expect the company to face tough questions about regulatory exposure and potential impacts on its AI advertising operations.